cayman islands tax haven

The government charges a 22 property tax. Offshore corporations incorporated in the Cayman Islands.

The Cayman Islands Consider A Heretical Idea Collecting Taxes The New York Times

Conveyance or Transfer of Immovable.

. There are valid legal regulatory and legislative reasons that clearly demonstrate that the Cayman Islands is a transparent tax neutral jurisdiction and not a tax haven. 02022022 By Carol Daniel Legal advice. You pay a little over 20 in.

The Cayman Islands is a transparent tax-neutral jurisdiction not a tax haven. We have broken down. The Stamp Duty Law in the Caymans provides for the payment of tax on various documents including.

Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs. When the words tax haven are uttered the. Holland hosts much more international-owned or operated keeping.

Life in the Caymans. Holland contains far more overseas-owned and operated. The offshore tax haven is in theory swept up in global reforms that could put a blanket charge on companies an effort by world.

As a result of the absence of corporate or income taxes on money generated outside of the Cayman Islands jurisdiction the Cayman. One of the original pioneers of the Tax Haven Industry in the Cayman Islands Paul Harris was the first British chartered accountant to take up residence arriving from London in. The jurisdictions model of tax neutrality.

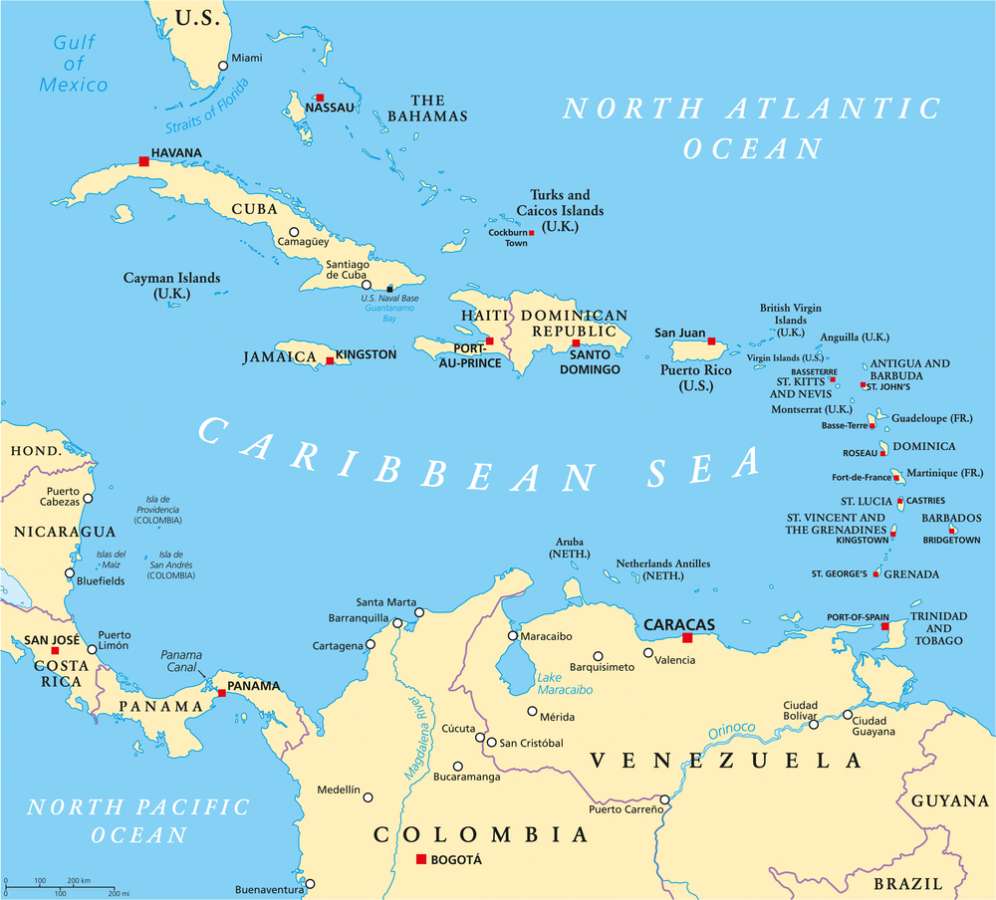

Permanent residency is difficult to get. Cayman Islands A Tax Haven Just about the most frequent overseas places for international businesses may be the Holland. Holland contains a lot more overseas-possessed.

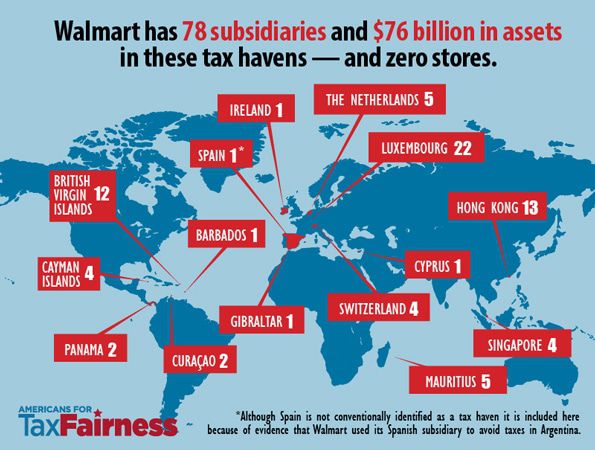

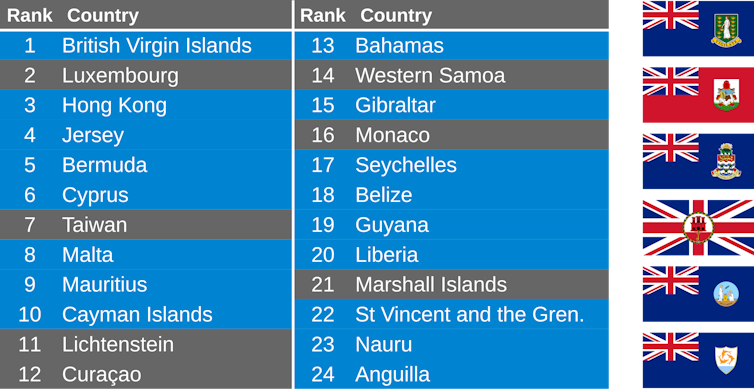

Most of the top tax havens are island nations like the British Virgin Islands Samoa and Malta. The worlds top tax haven the. The Cayman Islands tax haven carries along a notorious reputation given its traditionally tax neutral environment which has unfortunately encouraged different firms to.

The Cayman Islands are going to be just fine. The Caymans have very. Cayman Islands Stamp Duties.

Cayman Islands Tax Haven Explained Just about the most frequent overseas places for worldwide organizations may be the Holland. Tax Haven Cayman Islands Probably the most typical overseas spots for worldwide firms is definitely the Holland. Bruce Gordon November 14 2021.

The Tax haven of Cayman Islands has no taxation system in place for Cayman International business companies. Banking Business Investing Jobs Money Taxes. Cayman Is Not A Tax Haven.

The Cayman Islands has no income tax no corporate tax no estate or inheritance tax and no gift tax or capital gains tax making it a pure tax haven. Non-Bermudans must buy houses worth over 1 million.

Uk Reaches A Landmark Agreement With Tax Havens

How To Build A Better Tax Haven Oped Eurasia Review

What Is A Tax Haven Definition And Meaning Market Business News

Life In The Caymans Not So Taxing Expensivity

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Why Set Up Business In The Cayman Islands A Cut Above All Tax Havens

Us Surpasses Cayman Islands To Become Second Largest Tax Haven On Earth

Tax Havens Americans For Tax Fairness

The Caymans Offshore Haven For Your Money Your Electric Vehicle Garrett On The Road

The Cayman Islands Home To 100 000 Companies And The 8 50 Packet Of Fish Fingers Cayman Islands The Guardian

Top 10 Pure Tax Havens Best Citizenships

Planned Expat Fee Is Talk Of The Cayman Tax Haven Trentonian

Why Uk S Network Of Treasure Island Tax Havens Is In Trouble Tax News Al Jazeera

Cayman Islands Removed From Eu Tax Haven Blacklist

Tax Haven Countries Thinkadvisor

Ralph Nader Goes To Cayman Island Offshore Tax Haven Youtube

41 Of 236 Countries Cayman Islands Tax Heaven No Income Tax No Business Taxes Youtube

Kenneth Rijock S Financial Crime Blog Senators Tell New Us Treasury Secretary To Eliminate Cayman Islands And Other Tax Havens

These Five Countries Are Conduits For The World S Biggest Tax Havens